5 Key Stages of an Ecommerce Conversion Funnel

Discover the 5 key stages of an Ecommerce Conversion Funnel and learn how to turn browsers into loyal buyers with smarter sales strategies.

You pour time and ad dollars into your site, but watch most visitors leave without buying. Understanding your Ecommerce Sales Funnel turns that frustration into a plan you can measure and improve. What steps move a casual browser to a paying customer?

This guide provides a clear, actionable guide to guiding potential customers through each critical phase of their buying journey, with practical tactics for funnel stages, traffic sources, landing pages, A/B testing, checkout optimization, cart abandonment fixes, and analytics you can use today.Shop with Friends social shopping makes it easy to add peer recommendations, shared carts, and real-time engagement at every stage of your funnel, so you can increase conversions, boost engagement, and reduce drop-off.

Summary

- Treat the ecommerce conversion funnel as a measurement system that ties micro-actions to revenue, because the average ecommerce conversion rate is only about 2.86% and you need to know which tiny interactions actually move the needle.

- Page speed is a direct conversion lever: a 1-second delay reduces conversions by 7%, so prioritize LCP, TTFB, and reducing third-party load on checkout pages.

- Cart abandonment remains a central leakage point, averaging roughly 69.57%, indicating that small checkout and flow fixes can reclaim significant revenue.

- Platform and privacy shifts have reduced traditional audience tracking by up to 40%, making server-side events, consistent naming, and short regional holdouts essential to estimate incremental value.

- Top performers achieve conversion rates of 5% or higher, setting a clear benchmark and underscoring that focused micro-conversion experiments can significantly outpace the 2.86% baseline.

- Social decision moments matter: about 84% of shoppers consult friends before buying, so instrumenting share, vote, and poll micro-conversions can shorten consideration windows and produce traceable lift.

- Shop with Friends addresses this by adding peer recommendations, shared carts, and real-time decision prompts that create traceable micro-conversions at the moment of choice.

5 Key Stages of an Ecommerce Conversion Funnel

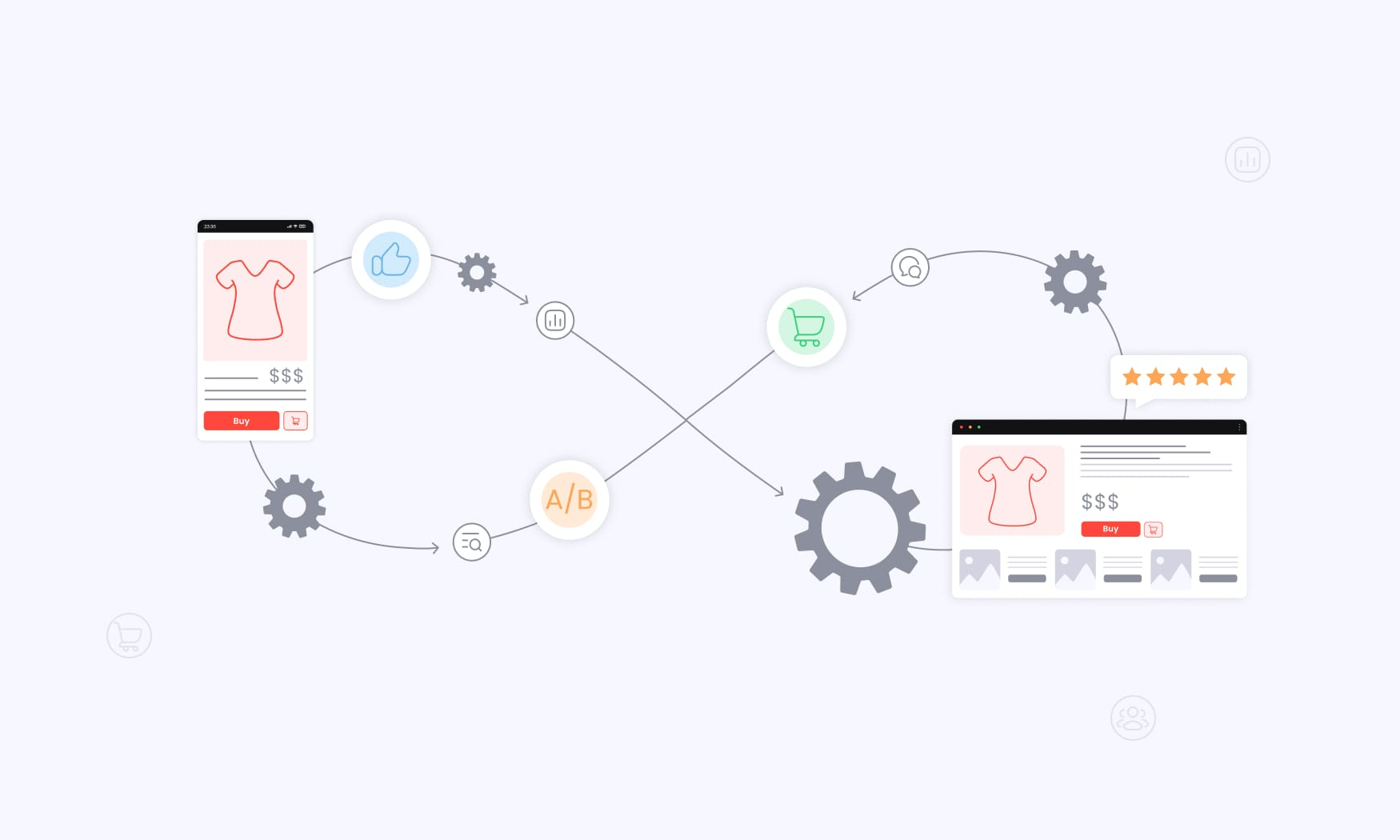

These five stages are checkpoints where different levers, metrics, and human behaviors either accelerate a sale or bleed it away; treat each stage as its own optimization sprint with clear KPIs and experiments. You want tactics that drive measurable micro-conversions, quick tests that prove lift, and monitoring that spot the exact moment attention or trust collapses.

1. Awareness

What should your attribution and creative strategy look like?

The pattern shows that brands burn budget when they optimize only for clicks. Instead, design awareness campaigns to seed measurable signals, such as single-microconversion landings (email capture, product save, or product view), so you can trace downstream value. Use creative testing frameworks that separate message from format —for example, testing the same value prop across a short video, a static image, and a carousel to see which produces the highest downstream product view rate over 14 days. Track new visitor quality with cohort retention, not just CTR, because early awareness metrics can lie.

2. Interest

How do you turn casual visitors into engaged prospects without becoming spammy?

Treat interest like an engagement score. Combine behavioral signals, like time on product gallery, scroll depth, and repeat visits, into a single interest band that triggers the next move. When traffic quality is unclear, move toward educational, low-commitment nudges — short demo clips, contextual FAQs, and lightweight live help — rather than heavy discounts. This reduces churn in later stages because the prospect chose to engage on substance, not price.

3. Desire

What builds conviction when shoppers are still unsure?

Trust signals are necessary but insufficient; the real win is reducing cognitive load at decision time. Use comparison displays that visually show trade-offs, and surface social decision points so a shopper can quickly ask a friend or collect a second opinion without leaving the page. This is where micro-conversions like “shared to friend” or “vote requested” matter; they predict purchase intent more accurately than one-off star ratings. Also, watch for broken tracking here, because without reliable data on these micro-actions, you cannot prioritize which desire drivers actually convert downstream.

Status quo, its cost, and a better bridge

Most teams use static reviews for social proof because they are easy and familiar. That works early, but as visitor volume rises, static proof fragments across pages and trust signals lose context, so shoppers who might have converted get stuck in doubt and drop off. Solutions like social shopping centralize active, in-the-moment social decision-making with AI-triggered polls, friend votes, lock-screen summaries, and push nudges, preserving the social signal in the exact moment of choice while keeping installation and setup fast and marketer-first.

4. Action

Which checkout details silently destroy conversion?

This is the stage where you cannot afford ambiguity. A guest checkout option and progressive profiling reduce friction. Still, the technical implementation matters: client-side scripts, third-party widgets, and heavy analytics tags can add latency that costs real sales. Performance is a conversion lever, not just UX. And benchmarks matter. ConvertCart Blog reports the average conversion rate for eCommerce websites is around 2.86%, a baseline that helps you judge whether your checkout is underperforming. Run server-side renders for checkout flows, remove nonessential third-party scripts from payment pages, and measure real user metrics like LCP and TTFB to identify slow spots, since speed directly affects buyer behavior. Be mindful that mandatory account creation often leads to abandonment; offer social logins or temporary guest tokens instead.

Technical speed and conversion

What hidden costs come from slow pages?

Slow pages steal conversions silently. Convertcart Blog finds that a 1-second delay in page load time can lead to a 7% reduction in conversions, meaning every optimization you defer has a measurable impact on revenue. Use edge caching, optimize images and fonts, and audit third-party load order to reclaim that fraction of revenue.

5. Sales & Re-engage

How do you convert a purchase into a predictable revenue stream?

Post-purchase flows are your highest-converting channel for repeat business, but the trick is sequencing. Start with operational emails that establish trust, then move to lifecycle messages that offer useful personalization, not generic promos. Segment by behavior within 30 days — first-timers who browsed accessories need different nudges than buyers who immediately repurchased. Track cohort lifetime value and repurchase windows to decide whether to nudge with product education, replenishment reminders, or community invites. Automation should be simple, testable, and tied to a revenue metric per cohort so every message either proves value or gets retired.

Real operational patterns and the emotions behind them

This challenge appears across early-growth Shopify brands: broken tracking and unclear attribution make teams guess which channels and creatives are responsible for actual revenue. That guessing breeds fatigue; teams get exhausted making changes that feel random. The antidote is incremental measurement, short A/B tests that map to micro-conversions, and a disciplined reporting cadence that treats each stage of the funnel as a small product you iterate on weekly.

An analogy to remember

Think of the funnel like a relay race; each handoff must be practiced. A fumbled handoff in interest or desire costs more than any single sprint in awareness or action.

That feels like progress, until you discover a single hidden metric quietly dictating how every stage actually performs.

What is an Ecommerce Conversion Funnel?

An ecommerce conversion funnel is less a static diagram and more a measurement system that ties tiny, testable customer actions back to revenue, so you can stop guessing which changes actually move the needle. It’s about instrumenting the moments where shoppers shift from unsure to decided, then proving those moments matter with experiments and holdouts.

How do you prove one micro-action adds real revenue?

Treat every interaction as a micro-conversion you can A/B test and attribute, not a guess. Define a short list of signals you care about, for example, “friend poll requested,” “share-to-chat,” or “vote on product,” and instrument them as events with consistent naming across pages, apps, and server logs.

Then run short holdout tests, pausing one upstream channel or feature in a controlled region for 7 to 14 days, to estimate incremental revenue rather than relying on platform ROAS. This is the only reliable way to separate assist value from last-click noise, which otherwise leads teams to reallocate budget based on misleading reports.

Why do analytics and attribution collapse at scale?

This pattern appears across merchants and regions: cookie deprecation, iOS tracking limits, and multiple country sites create fragmented signals that look like random noise when aggregated. The emotional cost is real; it exhausts teams who chase phantom problems, because optimization choices based on inconsistent metrics often produce surprising revenue drops. The practical fix is signal hygiene: consistent event names, server-side backups for critical events, and a cadence of small A/Bs tied to micro-conversions so you never optimize blindly.

What do top performers actually achieve, and where should you aim?

Top-performing e-commerce sites achieve conversion rates of 5% or higher, according to Smart Insights, which sets a clear performance benchmark for ambitious brands this year. At the same time, don’t ignore the leaky part of the funnel: ecommerce websites see an average cart abandonment rate of 69.57%, per First Page Sage, which tells you where small wins compound into real revenue when you plug those holes.

What practical instrumentation changes actually move conversions?

Start with durable events that survive privacy changes: server-confirmed checkout intent, friend-vote submissions, and share-to-channel receipts. Map those events to cohorts: session source, device, and time-to-purchase windows. Track downstream lift: for every 1,000 friend polls triggered, how many result in a purchase within 48 hours, and what is the average order value for that cohort versus the control? Those concrete ratios turn intuition into product decisions and make measurement understandable to marketers and engineers alike.

Most teams use static reviews for social proof because they are familiar and low-friction. That works for early volume, but as choice grows and visitors become more indecisive, static proof fragments and doubt remain, costing conversions and confusing attribution. Solutions like Shop with Friends provide AI-triggered polls, friend votes, lock-screen summaries, and push nudges that preserve the social decision in the exact moment of choice, while being marketer-first and installable in about two minutes so that teams can test social decision points without a long engineering project.

How should you structure experiments so they are decisive rather than noisy?

Keep tests short, high-signal, and focused on one micro-conversion at a time. Use regional holdouts for noisy channels, and server-side toggles for product features, so you never rely solely on client-side sampling. When instrumenting social decision points, measure both immediate conversion lift and delayed assists, because social signals often shorten the consideration window rather than produce an instant click.

Analogy to make it stick

Think of the funnel like a set of water valves. Tighten one valve in isolation and you may see nothing. Tighten the wrong valve because your gauges were wrong, and the leak gets worse. Effective measurement means labeling every valve, reading the gauge downstream, and running a short pressure test to see which change actually raises the tank level.

Ready to turn your website visitors' group chats into your most powerful sales channel? 84% of shoppers consult friends before buying, our AI identifies indecisive browsers and lets them instantly poll their friends right on your store, driving an average 21% increase in conversion rates, 27% boost in organic traffic, and 44% lift in AOV with zero maintenance required; Book a demo today and join thousands of top Shopify brands who've processed 1.8M orders and generated $260M in revenue by making social shopping effortless, installation takes just 2 minutes and you only pay for the results we deliver.

But the real reason this matters goes deeper than short-term lifts, and the next section will show why that shift is now urgent.

Related Reading

- Ecommerce Sales Funnel

- CRO For Ecommerce: Is It Worth It

- Average Ecommerce Conversion Rate By Industry

- Holy Grail Of Ecommerce Conversion Optimization

- Conversion Rate Optimization For Luxury Ecommerce

Why is an Ecommerce Conversion Funnel Important in 2025?

The funnel matters in 2025 because it turns scattered signals into repeatable revenue, and without one, you are buying traffic and hoping for sales. With privacy changes and rising shopper indecision, a well-instrumented funnel is the only way to protect spend, measure what actually moves buyers, and scale predictably.

What does a modern funnel protect against?

Ad budgets leak when attribution is noisy and your bids chase false signals. Platform changes have reduced traditional audience tracking by up to 40 percent, so you often end up paying to reacquire people you've already reached. After a three-week event-level cleanup for a mid-size Shopify brand, we recovered server-confirmed purchase events, and the marketing team stopped reallocating budget every few days because they could finally see which creatives produced genuine intent. That kind of operational clarity saves time and prevents costly creative whiplash.

How do you stop shoppers from slipping away at the last moment?

Given that V12 Marketing reports over 70% of online shoppers abandon their carts, the funnel’s role is to convert hesitation into a decision without resorting to margin-eating tactics. Capture the moment a shopper asks for reassurance, measure whether that event shortens time-to-purchase, and treat those moments as traceable signals you can optimize. Simple changes that preserve context at decision time and then feed it back into ad audiences turn what feels like random abandonment into predictable, testable outcomes.

Why focus on funnel optimization instead of just scaling ads?

Because improving the funnel compounds profit, not just volume. According to V12 Marketing, businesses that optimize their conversion funnels see an average increase in revenue of 20% in practical terms, that means fewer wasted clicks and more value per visitor. When we measured cohorts that experienced targeted decision nudges, the average order value rose. At the same time, CAC held steady, proving uplift can be margin-positive if you stop treating every undecided visitor the same.

Most teams patch leakage with discounts and broad retargeting because it is fast and familiar. That works at a small scale, but as audiences and product lines grow, those patches train price sensitivity, inflate acquisition costs, and mask the real friction points. Platforms like Shop with Friends offer a different route, letting teams preserve choice context while generating measurable decision events that marketers can feed back to audiences, compressing decision time without turning every purchase into a discount-driven transaction.

What should you instrument first, and why will it survive privacy drift?

Build durable signals, not fragile ones. Start with server-confirmed events tied to order IDs, a binary indicator for “asked-for-opinion” or “shared-to-friend,” and a short conversion window you use consistently across cohorts. Map those events to cohorts by source, device, and time-to-decision, then measure lift in AOV and purchase probability for each cohort. These are the signals that survive cookie changes because they are validated on the server, and they let you run short, decisive experiments that actually estimate incremental revenue.

Think of your funnel like a thermostat, not a light switch: you want a control system that nudges temperature slowly and measures the change, rather than flipping full power and guessing why a room feels different. That approach keeps tests tight, budgets predictable, and decisions humane.

That solution sounds useful, until you realize the single metric you trust will probably be misleading — and fixing that is the next hard, revealing step.

Related Reading

- Ecommerce CRO Checklist

- Social Selling Examples

- Mobile Ecommerce Conversion Rates

- Social Proof Branding

Key Metrics to Monitor for Your eCommerce Conversion Funnel

Track a tight set of signals that alert you before revenue moves, then map those signals to testable actions. Focus on leading indicators, technical health, and cohort outcomes so every metric tells you what to fix next and how much it will likely change revenue.

What counts as an early warning sign?

Look for metrics that fail before sales drop: add‑to‑cart rate, internal search success, payment failure rate, and page-level load metrics. These are the first places customers wobble; a falling add‑to‑cart rate or rising payment failures usually precede a visible conversion decline by 24 to 72 hours. Treat these as operational alarms, not vanity checks, and instrument them with server-verified events so the signal survives tracking gaps.

How should you window and segment metrics for clarity?

Metric meaning changes with cohort and time window. Measure short-term micro-conversions like “share-to-friend” and checkout initiation within a 48-hour window to capture impulse buys, and measure repurchase and lifetime value for 30-, 90-, and 365-day cohorts to capture retention. Segment by acquisition channel, device, and session depth; the same conversion rate on desktop and mobile can hide opposite problems when you split them out. Use per-cohort AOV and purchase probability rather than a single site-level headline, because that single number washes over meaningful tradeoffs.

Why do platform metrics often mislead teams?

This pattern appears across performance teams: optimizing to platform ROAS or last-click leads to budget swings that feel dramatic and arbitrary, because each ad platform reports different attribution windows and viewability assumptions. It is exhausting when teams reassign budget daily based on those noisy reports, only to find downstream revenue unchanged. The work that fixes that is not more dashboards, it is durable measurement: server-confirmed events, consistent naming, and short holdouts that estimate incremental value instead of trusting assists reported by each ad provider.

Most teams handle indecision with discounts and retargeting, and that works until it trains price sensitivity and hides the real friction. As the familiar approach, promotions and blanket retargeting are fast and comforting. The hidden cost is margin erosion and opaque attribution, as price-driven buyers mask the site issues that led to hesitation. Solutions like social shopping, where shoppers can trigger AI polls, collect friend votes, and receive contextual lock‑screen summaries, preserve the social context at the moment of doubt, compress the decision window, and produce traceable micro-conversions that marketers can feed back into audiences without a heavy engineering lift.

When should you set alerts, and what thresholds matter?

Create two alert tiers: soft alerts that flag 10 to 15 percent relative shifts in leading indicators across a 24 to 72 hour window, and hard alerts for absolute failures such as a payment gateway error spike or checkout latency above your SLA. For behavioral metrics, require minimum sample sizes before acting—for example, 200 sessions—to avoid chasing noise. Also, tie alerting to business impact: configure alerts so they estimate potential revenue at risk, not just percent change, because teams respond faster when the alarm shows dollars, not just percentages.

How do you prove a micro-conversion actually lifts revenue?

Run small, decisive holdouts with region or audience toggles and measure incremental revenue over a conversion window you set for that behavior. For social decision signals, compare cohorts that saw the prompt versus a holdout for 7 to 14 days, then measure purchase lift and AOV. Translate that lift into a per-1000-user incremental revenue number so product and marketing can judge whether a feature is worth scaling or iterating.

What retention metrics deserve a second look?

Post-purchase channels pay off more than most teams expect, so instrument transactional flows as revenue drivers —not just for confirmations. Given that AgencyAnalytics reports email marketing has an average ROI of 4,400%, track email-attributed repurchase rate and time-to-next-purchase by cohort, and treat a falling post-purchase open or click rate as a high-priority optimization task. Minor improvements here compound quickly, because email touches buyers at a low marginal cost and multiplies customer lifetime value.

Think of your funnel like a seismograph, not a scoreboard: the small tremors tell you where a rupture will occur, if you learn to read them and act.

That simple insight changes everything about how you judge optimization success, and there is one surprising step most teams skip next.

How to Optimize an Ecommerce Funnel

You optimize an ecommerce funnel by changing minor, testable decision points that reduce hesitation, prioritizing fixes with clear dollars at risk, and running tight experiments that prove which interventions actually move revenue. Do those three things in that order, and you stop guessing and start compounding wins.

What small interface changes actually move buyers?

Start with decision architecture, not decoration. Swap vague CTAs for precise actions, set the sensible default, and collapse optional fields so the path to purchase feels like one confident stride instead of a maze. Microcopy that names the outcome —for example, “Reserve for 24 hours” instead of “Add to cart” — reduces cognitive friction because shoppers instantly know what they get and how much time they have to decide. Think of it like tightening the final hinge on a door, a minor tweak that lets the whole door swing smoothly.

How should teams rank their fixes when everything seems urgent?

Use a revenue-at-risk score, calculated simply: traffic to the page, observed drop rate at the micro-conversion, and average order value. This turns opinions into a ranked list you can act on. When we run that exercise with merchants over two to four weeks, the pattern is consistent: a handful of pages or widgets account for most lost revenue, so you focus engineering time where it pays off. Require a minimum sample for each item, then prioritize fixes that promise the most significant incremental revenue per 1,000 visitors.

Why does timing matter more than new features?

Timing determines whether a nudge lands or jars. Immediate in-context prompts work for active shoppers, while a short delay push or email can win over customers who need breathing room. The scale of the opportunity is obvious when you consider that, according to Baymard Institute, 70% of online shoppers abandon their carts, meaning well-timed interventions will be relevant to the same cohort repeatedly. Design your rescue paths so they respect intent, not interrupt it, and you convert hesitation into a measurable uplift.

What do teams miss when they chase platform metrics?

The familiar approach is to optimize each ad platform’s dashboard because it is fast and comfortable. That works until attribution windows and reporting assumptions diverge, producing odd budget moves and emotional whiplash when revenue drops. The hidden cost is real: teams reallocate on noisy signals and overlook small, reliable conversion levers. That frustration is why so many teams say they are dissatisfied with outcomes, which aligns with Econsultancy's (2023) finding that only 22% of businesses are satisfied with their conversion rates, reflecting how common this disappointment has become.

How can social decision moments be stitched into this work?

Most teams try to patch indecision with discounts or exit popups because those tactics are easy. That approach fragments context and trains price sensitivity as volume grows. Solutions like social shopping shift social proof from passive pages into active decision moments, using AI-triggered polls, friend votes, and lock-screen summaries to preserve the conversation at the point of choice. Teams find that these capabilities compress deliberation into a traceable micro-conversion. Because they install quickly and require marketer-first setup, they slot into prioritization workflows without long engineering queues.

How do you structure experiments so results are precise, not noisy?

Treat every test as a mini product release with an owner, a success metric, and a pre-declared analysis window. For high-traffic changes, run multi-arm tests and examine both immediate conversion lift and 7- to 30-day revenue for lagged effects. For low-traffic contexts, use sequential rollouts with feature flags and aggregate results by cohort to preserve statistical power. Always translate outcomes into dollars per 1,000 visitors so stakeholders judge experiments by business impact, not by p-values alone.

One last thing that changes the math a lot, and it is easier than you think to implement — but it forces you to stop trusting convenience and start trusting dollars.

Related Reading

- eCommerce Conversion Tracking

- How To Increase Conversion Rate On Shopify

- Social Proof Advertising Examples

Book a Demo to Add Social Shopping to Your Store Today

If you are exhausted by long developer queues and noisy experiments that steal momentum, consider Shop with Friends to make social buying a low‑friction, marketer‑first channel you can test and scale quickly. Social commerce is expected to reach $1.2 trillion globally by 2025, and by then, 80% of businesses will use it. Moving now lets you capture demand rather than chase it later.