Holy Grail Of Ecommerce Conversion Optimization

Discover the holy grail of ecommerce conversion optimization, proven tactics to boost sales, lower bounce rates, and maximize every customer visit.

You pour money into traffic, watch sessions climb, then see carts abandoned and conversion stuck at one percent. Those leaks appear at every stage of the Ecommerce Sales Funnel, from landing pages and product pages to checkout and post-purchase flows.

Which levers actually move the needle — A/B testing, page speed, clearer calls to action, better product visuals, personalization, trust signals, behavioral analytics, or more intelligent segmentation? This guide offers a clear, actionable playbook that leverages conversion rate optimization, heatmaps, checkout optimization, and social proof to minimize cart abandonment, enhance average order value, and drive sales growth.Shop with Friends turns social proof into social shopping, seamlessly integrating into your funnel to enable customers to share picks, expedite decisions, and convert more frequently, ultimately increasing your site conversion rates and driving ecommerce sales growth.

Summary

- Conversion optimization is an operational discipline, not a checklist, and disciplined CRO can reach top-performing sites that achieve an 11.45% conversion rate, compared to a 2.86% industry average, demonstrating how systematic fixes compound into outsized revenue.

- Cart abandonment is the single quickest signal of last-mile failure, with rates as high as 69.57% reported, so triage should focus on payment methods, shipping surprises, and device-specific drop-offs rather than generic fixes.

- Personalized product recommendations are high-leverage, with reported conversion uplifts of up to 300%, making recommendation rules a priority on product pages to increase attachment rates and AOV.

- A/B testing is a compound-growth strategy, with average conversion boosts of around 20%. Reliable measurement requires randomized holdouts and cohorts of 60 to 90 days to capture return and retention effects.

- Small metric shifts matter more than vanity KPIs, because a 3 to 7 percent drop in the add-to-cart rate will often prefigure a similar downstream impact on orders, and baseline averages near 2.7 to 2.86 percent mean even fractional lifts can change unit economics.

- Static social proof fragments trust as volume scales, while shoppers increasingly use personal channels to make decisions. Given that over 50 percent of Gen Z and Millennials have made purchases through social media, and 73 percent of businesses plan to increase their social commerce investment, this trend is likely to continue.

- This is where Shop with Friends fits in; it addresses indecision by surfacing in-context friend input and lightweight in-store polls at the moment of decision, compressing time-to-purchase while preserving attribution.

15 Ecommerce Conversion Optimization Tools to Boost Sales and Enhance User Experience

These 15 items comprise the practical toolset you need to boost conversions, minimize friction, and make buying feel inevitable rather than accidental. Below, I map each focus area to specific tools, their usage, the behavior to measure, and the practical trade-offs that determine when to use each approach.

1. Know Your Customers

Utilize targeted micro-surveys and live chat to eliminate guesswork and prioritize fixes. Tools: Qualaroo for two-question intent intercepts on cart and product pages, Olark for live rescue chats, and SurveyMonkey for segmented post-purchase follow-ups. When we ran short Qualaroo intercepts for three weeks on a midsize store, it exposed consistent shipping worries that reshaped messaging in the checkout flow, cutting churn points in the hypothesis pipeline.

2. Home Page Optimization

Treat the home page like a curated storefront rather than a billboard. Tools: Optimizely or VWO for hero experiments, Vidyard or Loom for short product demos, and GeoIP/localization plugins to swap currency and shipping cues. Measure click-throughs on featured SKUs, time-to-first-interaction, and bounce rate for first-session visitors.

3. Navigation Optimization

Make navigation answer-driven, not taxonomy-driven. Tools: Crazy Egg or Hotjar to capture click maps and scroll heat, Algolia for fast faceted menus, and simple CMS tweaks to promote best-sellers. Think of navigation like a grocery aisle: if essentials are hidden behind alphabetized categories, shoppers leave frustrated.

4. Product Search Optimization

Search should be a fast path to purchase, not a mystery tour. Tools: Algolia or Elasticsearch for typo-tolerant relevancy, Klevu for commerce search features, and add auto-suggest plus category filters. Track success via the search-to-cart rate and the percentage of searches that return zero results; those zeros are always high-leverage fixes.

5. Product Page Optimization

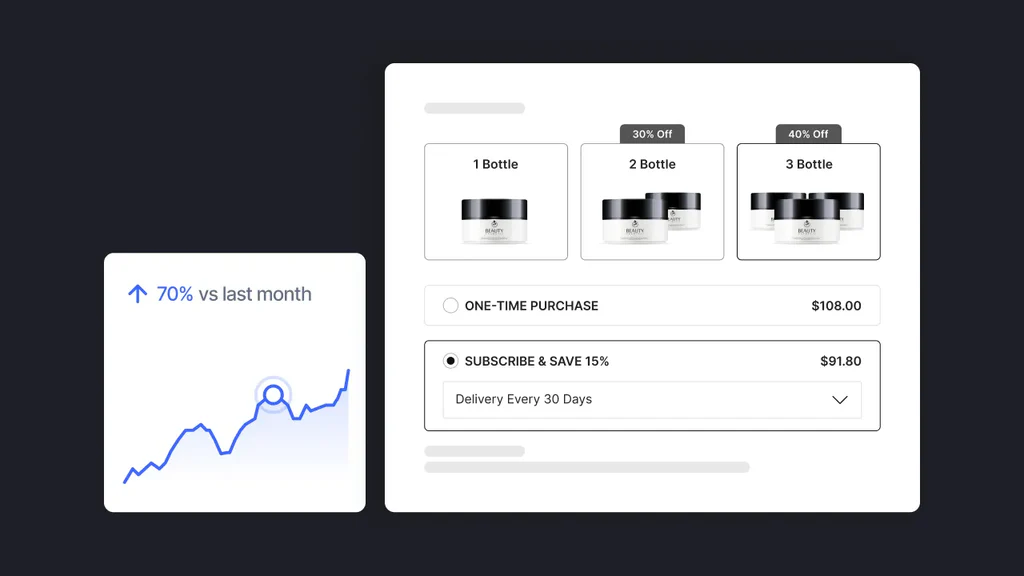

Optimize trust, clarity, and next-step intent on every SKU page. Tools: Gorgias for integrated support widgets, Cloudinary or ImageKit for image performance and responsive delivery, and Fomo or Nosto for social-proof modules. Use recommendation engines to surface complementary items and increase basket size. According to Conversion rates, basket size can increase by up to 300% when using personalized product recommendations. This scale of uplift shows why recommendation rules belong in the product page playbook, not later in the funnel. Monitor upsell attach rate and average order value to validate impact.

6. Checkout Optimization

Remove friction with predictable flows and clear affordances. Tools: Shopify Payments and Stripe for fast guest checkout, Klarna or Afterpay for flexible payment options, and ReCharge for subscription capabilities. Watch for field-level error rates and time-on-form; each extra required field costs momentum.

7. Touch Point Optimization

Make every touch point feel human and useful. Tools: Klaviyo for lifecycle email flows, Sumo for welcome popups that respect frequency, and Open Graph validators for social previews. Track open-to-click ratios and post-order engagement as indicators of trust-building.

8. Information Touch Points

Utilize product videos, buying guides, and an honest 'About' page to convert strangers into buyers. Tools: Wistia for hosting near-sell videos, Typeform for interactive buying guides, and Zendesk or Intercom for accessible contact. A well-placed guide reduces returns and increases confident purchases.

9. Load Speed Optimization

Speed is a conversion lever you can tune today. Tools: Cloudflare or Fastly for CDN, Google PageSpeed and Lighthouse for audits, and image CDNs, along with lazy-loading, to reduce payload. Faster pages lower abandonment, so prioritize above-the-fold payload first and defer peripheral scripts.

10. Shipping and Returns

Make shipping thresholds and returns policies simple signals of trust. Tools: ShipStation for clear multi-carrier options, EasyShip for international rules, and Returnly for smooth reverse logistics. Present free shipping thresholds early, and measure the conversion lift at each price threshold.

11. Customer Re-Targeting

Re-engage intent with tailored creative and incentives. Tools: AdRoll and Google Ads Remarketing for cross-site follow-up, Klaviyo for segmented cart recovery, and Retention.com for on-site behavioral signals. Keep email lists clean and measure re-engagement rates, because wasted sends blunt your ROI.

12. User Experience (UX) Design

Design around decisions, not features. Tools: Figma for rapid mockups, FullStory for session replay, and Optimizely for iterative experiments. A well-organized experiment backlog with owners and timelines yields far more benefits than sporadic redesigns.

13. Mobile Optimization

Make mobile the primary experience for many customers, not an afterthought. Tools: BrowserStack for device QA, Google AMP or responsive frameworks for fast mobile pages, and mobile wallets (Apple Pay, Google Pay) to cut checkout time. Track mobile conversion separately; what works on desktop often fails in thumb zones.

14. Analytics and Testing

Systematize learning with rigorous experimentation and clear priors. Tools: Google Analytics 4 for event tracking, Optimizely or VWO for A/B testing, and Segment for event governance. According to A/B testing, conversion rates increase by an average of 20%. Committing to regular tests is a compound-growth strategy; prioritize high-traffic funnels and stop guessing. Measure both short-term lifts and downstream metrics like LTV and return rate.

15. Conversion Rate Optimization Strategy

Transform individual experiments into a comprehensive operating system for growth. Tools: Airtable or Notion for experiment registries, Looker or Mode for combined dashboards, and Slack integrations for launch alerts. Build a cadence: weekly hypothesis vetting, biweekly launches, and monthly impact reviews tied to revenue.

Most teams handle social proof and feedback through static reviews and badges because that approach is familiar and requires no new workflows. Over time, that familiarity fragments trust signals, leaving indecisive shoppers unsure who to believe and reducing the marginal value of every badge. Platforms like social shopping offer an alternative path, providing in-context friend input, in-store polls that surface at the moment of decision, and AI that flags indecisive behavior, allowing teams to recover conversions by making opinions personal and timely.

Practical tradeoffs to keep in mind

If you need immediate wins, prioritize speed improvements, checkout simplification, and one recommendation rule; those are low-effort, high-impact. If your catalog is extensive and discovery-driven, invest in search relevancy, personalized recommendations, and a testing cadence to avoid fragile heuristics. When staffing is limited, favor integrations and managed services that reduce maintenance overhead over point solutions that require constant tuning.

A short analogy to close a practical loop

Think of your funnel like a relay team, where each handoff either accelerates or drops momentum; the tools above give you smoother batons and clearer lanes.

However, the real frustration lies in this: fixing individual tools may feel productive, until you realize the underlying decision architecture is still flawed — and that’s where the next question becomes interesting.

What is Ecommerce Conversion Optimization?

Conversion optimization is an operating discipline, not a one-off checklist. It means systematically identifying the highest-value frictions in the funnel, proving fixes with experiments, and treating conversion lift as predictable, measurable growth that can be compounded over time. When you run that as a repeatable system, small wins stack into outsized revenue increases and predictable ROI.

What should teams optimize besides purchases?

Focus on micro-conversions that predict final buys, like add-to-cart intent, poll shares, and time-to-decision, because these are the levers you can move quickly to change outcomes. When those micro-conversions improve, stores can approach the ceilings reported by WordStream. Top-performing ecommerce websites have conversion rates as high as 11.45% in 2025, which shows what disciplined CRO can achieve when decision architecture and execution align.

How do you pick which experiments matter most?

Prioritize by expected value, not novelty. Score ideas by traffic, current conversion rate, and the estimated lift if you fix the issue, then run quick tests on the highest-traffic nodes first. A sensible testing cadence strikes a balance between statistical rigor and velocity: protect against false positives by tracking downstream metrics, such as retention and return rate, and avoid chasing marginal lifts that compromise long-term value.

Why do some channels underperform, and what can be done about it?

This pattern appears across certain referral types, where intent differs and session depth is shallow, meaning the same landing page that converts from search will underperform for LLM or social referrals. The practical response is to tailor the first interaction: show more straightforward product utility, shorten the decision path, and insert context-rich social signals at the exact moment of hesitation so intent converts into action.

It’s exhausting when checkout friction eats the gains you earned upstream, and that fatigue is real for teams—reduced conversion often stems from predictability failures, not design failures. The solution is to instrument intent more finely, flag indecisive behavior, and recover those sessions with targeted nudges or in-context friend input, as small interventions at the moment of doubt often outperform wholesale redesigns.

Most teams utilize social proof with static badges because they are familiar and require low effort. As traffic and indecision scale, that approach fragments trust and leaves shoppers unsure. Platforms like social shopping provide a different path; they detect indecisive behavior, surface in-store polls on the lock screen, and let friends input arrive at the moment of product selection, compressing decision time from hours to minutes while keeping integration light and measurable.

What measurement mistakes should you avoid?

Watch for survivorship bias and overfitting experiments to noise, and stop treating conversion lift as an isolated KPI. Break results into cohorts by channel and product, monitor AOV and return behavior alongside lift, and use rolling windows to separate durable changes from novelty spikes. Think of the funnel like a ballot box; each interaction is a vote; you need repeatable majorities, not one-off wins.

That simple change in perspective reveals the next question you have to answer.

Related Reading

- Ecommerce Sales Funnel

- CRO For Ecommerce: Is It Worth It

- Ecommerce Conversion Funnel

- Average Ecommerce Conversion Rate By Industry

- Conversion Rate Optimization For Luxury Ecommerce

Why Ecommerce Conversion Optimization Matters

Conversion optimization matters because it converts marketing spend into predictable revenue and protects your margins as you scale, making growth a matter of skill, not luck. When you lift the percentage of visitors who buy, you lower acquisition cost per order, improve cash flow, and turn small experiments into a meaningful runway for the business.

How does this change your unit economics?

If your site sits near the market average, incremental lifts compound quickly, so knowing the baseline is crucial, especially when planning tests and forecasts. According to Speed Commerce, the average ecommerce conversion rate across industries is 2.86%. This baseline determines whether a 0.5-point lift is tactical housekeeping or a strategic lever. Use that context to model CAC sensitivity, breakeven volume, and how many extra orders a given improvement will buy you before you scale ad spend.

When should teams prioritize conversion work over acquisition?

Prioritize optimization when incremental traffic gives diminishing returns, or when inventory and margin management become fragile. Retail markets are shifting, so short-term traffic boosts do not guarantee sustainable sales; indeed, Retail ecommerce conversion rates have increased by 1.2% over the past year, which means competitors may already be squeezing gains from the same sources you chase. In that environment, tightening decision architecture is the cheaper, faster path to durable revenue than doubling media spend.

What do shoppers actually need when they hesitate?

They need timely, credible input that reduces uncertainty in the moment, not another badge on the page that asks them to trust an anonymous crowd. Most shoppers still use their personal group chats and screenshares to invite friends before making a purchase, because those conversations provide specificity and accountability. As those behaviors scale, brands that fail to capture the moment lose the sale without ever knowing why.

Most teams centralize friend feedback outside the product because it is familiar and requires no engineering; however, this approach fragments context and stalls decisions as the volume grows. As post-purchase questions accumulate in support queues and screenshots reside in ephemeral threads, conversion opportunities slip away. Platforms like Shop with Friends detect indecisive behavior with AI, surface in-store polls at the lock screen, and route friend input into the checkout moment, compressing decision time from hours to minutes while keeping integration light and measurable.

How do you reduce downstream risk and return costs through optimization?

Treat returns and refunds as leading indicators, not collateral. Run holdout cohorts for new messaging and feature changes for 60 to 90 days, track return rates by cohort, and apply Bayesian priors to low-traffic SKUs to avoid chasing noise. For example, use a 10 percent randomized holdout on a single high-traffic product to measure real-world return behavior before rolling changes site-wide. That preserves inventory planning accuracy and protects margin when you scale winners.

Why small changes can feel disproportionate in effect

Conversion work is more akin to tuning a mechanical watch than swapping out its face; a slight gear adjustment reduces friction throughout the entire movement. When you remove a single source of hesitation at the moment of decision, everything downstream pulses stronger: fewer abandoned carts, less support load, and a higher probability of repeat purchases. That is why a disciplined testing cadence, combined with clear holdouts, produces predictable and repeatable lift rather than one-off spikes.

If you want an operational rule that actually helps, treat conversion as risk management: prioritize fixes that shorten time-to-decision, lower variance in buyer expectations, and make intent observable. Do this with fast holdouts, channel-specific promise framing, and mechanisms that allow social input to arrive at the moment of choice.

The next piece reveals the surprising metrics that teams often overlook, which conceal the actual cost of indecision.

Related Reading

- Ecommerce CRO Checklist

- Social Selling Examples

- Mobile Ecommerce Conversion Rates

- Social Proof Branding

Key Metrics to Monitor in Ecommerce Conversion Optimization

Conversion and related KPIs should drive diagnostic choices, not vanity reporting. Watch trends, cohorts, and the event paths that link micro-conversions to final revenue, then act where the causal chain breaks.

Why does cart abandonment deserve immediate triage?

Cart abandonment is the single quickest signal that something in the last mile is failing. Given AgencyAnalytics' 2023 finding that cart abandonment rates are as high as 69.57%, treat spikes as a matter of urgency. Don’t chase generic reductions; instead, break abandonment down by payment method, promo code usage, shipping option, and device. When abandonment rises only with wallet payments, you fixed the wrong thing if you optimize product pages. Measure abandonment at the session-path level to determine whether shipping costs, unexpected taxes, or a slow final click are the true culprits.

How should you segment these metrics so they mean something?

Segment by acquisition channel, device, product category, and first versus returning buyers, and then run gap analysis across the segments. Platform-level ROAS can mask durable value, so treat channel reports as partial views and reconcile them against server events and revenue cohorts to ensure accuracy. This pattern emerges when teams optimize for a single dashboard metric, and the failure mode is obvious: a channel that appears costly on a click-level ROAS may actually drive higher AOV or CLV, which platform attribution overlooks. Score every experiment not only by immediate conversion lift, but by AOV and early retention signals for the affected cohort.

What measurement mistakes are actually wrecking your decisions?

Relying only on client-side pixels and a single tag manager creates blind spots and duplicated events. Many teams discover late that third-party script blockers, duplicate pixels, or misfired GTM tags cause inconsistent conversion counts. The technical pattern is consistent: client-side tracking drifts as the site and tag stack change, producing underreported purchases or noisy A/B test results. Address this issue with a server-side event pipeline, deduplication logic, and a strict event taxonomy. Then, reconcile server receipts with platform reports on a weekly basis to identify and address regressions before taking action.

Which leading indicators predict the revenue impact?

Not every metric needs equal attention. Add-to-cart rate, funnel drop at payment selection, and time-to-decision after a product view are high signals. For many stores, a persistent 3- to 7-percent drop in the add-to-cart rate prefigures a similar downstream impact on orders if traffic remains steady. Treat social interactions and in-session shares as micro-conversions that predict purchase intent, because they compress the variance in decision time and increase attach rates for cross-sells and warranties.

How often should you monitor, and what cadence drives reliable action?

Daily anomaly checks should flag sudden swings, but weekly cohort analysis and monthly LTV reviews are where durable decisions live. Run experiments with holdouts long enough to observe returns and early refunds, typically 60 to 90 days for physical goods. When traffic is volatile, increase cohort windows to avoid chasing noise; when traffic is stable, prioritize velocity and stop-loss rules so that experiments that harm retention are halted quickly.

Most teams capture friend input outside the site because it is familiar and requires no engineering, and that approach works early on. As order volume and indecision scale, context fragments, response times lengthen, and conversion opportunities slip away without clear attribution. Platforms like Shop with Friends detect indecisive behavior with AI, surface lightweight in-store polls on the lock screen, and route friend input into the checkout moment, compressing decision time and preserving the context that turns a cart into an order.

What should you track alongside these KPIs to avoid short-term thinking?

Always pair conversion lift with AOV, return rate, and 30 to 90-day repeat purchase rates for the affected cohorts. A bump in conversion that coincides with higher returns, or lower attach rates for add-ons, is a false victory. Use cohort-level economics to compute the real per-order value of an experiment before you scale it across channels.

Think of your metric system like a scaffold, not a scoreboard: the best systems show you where the structure is failing before the ceiling collapses.

That fix helps, but the next question reveals the measurements that actually determine whether those fixes stick.

How to Optimize Your Ecommerce Conversion Rate

Focus your work on the precise moment a shopper hesitates, then remove the uncertainty at that instant with tightly scoped experiments and clear incrementality tests. Treat decision speed and decision confidence as measurable KPIs. You can move faster than acquisition, and you will lift orders without doubling ad spend.

How do you find the exact moment shoppers stall?

This pattern is evident across direct-to-consumer and niche retailers: indecision is reflected in specific session behaviors, rather than vague bounce rates. Instrument events that mark hesitation, for example, repeated product toggles, returning to the same variant, long pauses on shipping or returns copy, or opening and then closing the cart. Rank sessions by a simple indecision score, calibrated to your baseline traffic, and prioritize the top 10 percent for recovery tactics. That gives you a high-leverage targeting set, because these sessions are already qualified demand, not cold prospects.

What experiments actually shorten decision time?

Run narrow, parallel tests that change only what the shopper needs at the hesitation moment. Try three tactics in small holds: dynamic micro-messaging that answers the single most-clicked question on the page; a lightweight in-context poll that routes friend input into the cart; and a commitment device, like a 30-minute hold that shows friend responses in real time. These moves trade guesswork for focused signals, and they cost little to run while you measure time-to-purchase and attach rate for add-ons. The practical tradeoff is simple: if you have limited traffic, test one idea at a time on your highest-value SKUs so the signal emerges quickly.

Why do incrementality tests matter more than uplift percentages?

The familiar KPI chase convinces teams to celebrate relative lifts without proving net new demand. Instead, run randomized holdouts, then measure net orders, AOV, return rate, and 30- to 90-day retention for the exposed cohort. Use survival analysis on time-to-purchase to see whether social input accelerates purchases or merely pulls forward purchases that would have occurred later. That distinction keeps you from scaling a tactic that raises short-term conversion but increases returns or cannibalizes higher-margin channels.

Most teams manage friend feedback outside the product because it feels familiar and requires no engineering. As volume increases, context fragments, responses slow, and those saved screenshots become invisible leakage, costing both conversion and support hours. Platforms like Shop with Friends identify indecisive shoppers using AI. These surface lock-screen polls incorporate friend input into the checkout moment, and deploy Shopify-native hooks that can be installed in minutes while preserving attribution and ROI tracking. This provides teams with a way to recover from decisions without introducing manual workflows.

When should you prioritize social decision support versus more ad spend?

If your store's conversion rate is near the market average, you should prioritize conversion work before expanding your spend, as small lifts compound quickly. Consider that BigCommerce's 2022 finding, that the average conversion rate of online shoppers worldwide is around 2.7%, frames the amount of headroom for improvement. For premium lines, the ceiling is lower, and each recovered decision is more valuable. This is evident in Convertcart's 2025 estimate, which shows that the average conversion rate for luxury brands is around 1% to 1.5%. As a result, even a slight increase of one point matters for the margin. Use those baselines to model how many orders you need to justify a feature rollout versus more media.

How do you preserve margin while boosting conversion?

Sequence your offers so the first nudge reduces uncertainty without lowering price. Use information-first interventions, such as real-time friend confirmations, concise shipping assurances, and explicit return windows, and then layer price incentives only when those fail. For pricier items, present financing options after confidence signals arrive, not before, because payment flexibility increases conversion only when uncertainty is already low. This preserves AOV and keeps returns from eroding gains.

What does good measurement look like in practice?

Set up three things before you launch: a randomized holdout that captures full checkout behavior, event wiring that ties friend interactions to order IDs, and cohort windows long enough to see returns and early repurchases. Track the per-order economics for the test and holdout cohorts, then calculate the lift in net revenue per visitor. Suppose the net revenue lift covers the cost of the feature within your investment horizon and scale. If not, iterate on the micro-experience rather than the marketing plan.

Think of the funnel like a river with one hidden rock that creates all the eddies; you can pour more water in upstream, but removing that rock smooths the flow for everything downstream. That one intervention—timely, contextual social input—changes how many carts become orders, and how valuable each order is.

That simple fix sounds final, but the next step reveals a challenge that will test how quickly you can turn curiosity into measurable revenue.

Book a Demo to Add Social Shopping to Your Store Today

After working with Shopify brands, a pattern emerged: teams want measurable increases in conversion, organic traffic, and average order value without adding maintenance. Reports indicate that 73% of businesses plan to increase their social commerce investment in the following year. If you want a practical, low-friction way to turn friend input into purchase confidence, consider Shop with Friends, a social shopping approach that brings decision support into the moment and captures shoppers who already buy socially, as it finds that over 50% of Gen Z and Millennials have made purchases on social media.

Related Reading

- eCommerce Conversion Tracking

- How To Increase Conversion Rate On Shopify

- Social Proof Advertising Examples